CALL US TODAY! (301) 475-5611

Up to 60 Months Interest-Free Financing *Financing available to well qualified buyers on approved credit at a 0% APR for 60 months, with equal monthly payments. No down payment required

Up to 60 Months Interest-Free Financing *Financing available to well qualified buyers on approved credit at a 0% APR for 60 months,

with equal monthly payments. No down payment required

CALL US TODAY! (301) 475-5611

Renewable Energy Tax Credits

Geothermal heat pumps are similar to ordinary heat pumps, but use the ground instead of outside air to provide heating, air conditioning and, in most cases, hot water. Because they use the earth's natural heat, they are among the most efficient and comfortable heating and cooling technologies currently available.

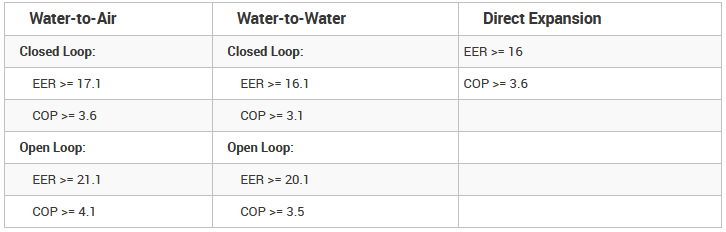

Requirements

Must meet the requirements of the ENERGY STAR program which are in effect at the time of the expenditure. Tax credits includes installation costs.

The home served by the system does not have to be the taxpayer's principal residence.

Definitions:

- COP (Coefficient Of Performance) - of a heat pump is the ratio of the change in heat at the "output" (the water reservoir of interest) to the supplied work.

- EER (Energy Efficient Ratio) - The higher the EER rating, the more energy efficient the equipment is. This can result in lower energy costs. This DOE site can show how to calculate potential energy costs savings of a more efficient unit.

The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods:

- 30% for property placed in service after December 31, 2016, and before January 1, 2020

- 26% for property placed in service after December 31, 2019, and before January 1, 2022

- 30% for property placed in service after December 31, 2021, and before January 1, 2033

- 26% for property placed in service after December 31, 2032, and before January 1, 2034

- 22% for property placed in service after December 31, 2033, and before January 1, 2035

What products are eligible?

Qualified geothermal heat pump

Equipment which:

(1) uses the ground or ground water as a thermal energy source (to heat), or as a thermal energy sink (to cool) a home, and

(2) is ENERGY STAR certified.

Qualified geothermal heat pump expenditure:

An expenditure for qualified geothermal heat pump installed on or in connection with the taxpayer's residence.

Who can use this credit?

- Existing homes and new construction qualify. Both principal residences and second homes qualify. Rentals do not qualify.

- This system must be installed in connection with a dwelling unit located in the United States and used as a residence by the taxpayer. The home served by this system does not have to be the taxpayer's principal residence.

- A principal residence is the home where you live most of the time. The home must be in the United States. It can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured home.